It’s 2021 and Ethereum and the DeFi protocols it houses are at record prices as the Year of the 0x charges off. What better time to learn how to earn that ETH? That’s why we’ve updated this supersized Ethereum Mining article to reflect the latest info for 2021.

Welcome to your ultimate guide to mining Ethereum, the world’s most versatile cryptocurrency and blockchain network. While Ethereum is migrating towards a Proof-of-Stake (PoS) network in the near future, there’s still a place for mining at present.

Learn from what mining is, to how it works, to how to join an Ethereum mining pool, how to choose an Ethereum mining hardware and software you’ll need, all the way to dealing with the Ethereum 2.0 upgrade, we’ve got you covered.

BTW, CoolWallet and MyEtherWallet are issuing a limited edition “Year of the Ox” -themed CoolWallet! If you love your ETH, this is a must-have!

Please be aware that many scam sites target Ethereum miners with fake reviews. Only buy from trusted sites.

Click here to order before 25 February 2020!

Table of Contents

- What is Mining & How Does It Work

- Ethereum Mining Explained

- How to Mine Ethereum

- Ethereum PoW Mining vs Proof of Stake (PoS)

- Ethereum Mining Pool

- How to Store Ethereum Offline

- Additional Ethereum Mining Resources

First, before getting into how to mine Ethereum, we strongly suggest you read up on what Ethereum is, and how this public and open-source decentralized computing platform and blockchain is enabling smart contracts and the deployment of decentralized applications (DApps).

Head on over to our comprehensive Ethereum guide which tackles:

- What smart contracts and DApps are,

- The core differences between Ethereum and Bitcoin,

- Ethereum’s advantages and disadvantages,

- Common use cases,

- How to buy ETH and more.

Brushing up on Ethereum’s history, integral components, most commonly used terms and concepts, and how it functions in today’s blockchain ecosystem will help you better understand the below ideas and language used. Keep in mind that this CoolWallet guide is purely educational and should be used as a starting point for users looking to start mining Ethereum and other cryptocurrencies.

Looking to mine Bitcoin instead? No problem, check out our all-encompassing guide on everything Bitcoin and how to mine it here.

Now, let’s get into what mining is and how to mine Ethereum (ETH).

1. What is Crypto Mining & How Does It Work?

Q: How do I explain Bitcoin to my grandpa?

— Josh Wolfe (@wolfejosh) August 17, 2018

While the above response was made in jest (and about Bitcoin), it provides a great example of the general public’s understanding (or lack thereof) of cryptocurrency, Bitcoin, and Ethereum mining.

Think back to the California gold rush of the mid-1800s, where 300,000 miners took to the streams and riverbed to score themselves a healthy portion of the loot.

Cryptocurrency mining draws upon the “gold” analogy associated with digital currencies, as both gold and precious metals are a rarity, along with digital currencies and tokens. And, initially the only way to generate and increase the total volume of cryptocurrencies was by “mining them” through an economic measure and consensus measure – known as Proof-of-Work or PoW. Now of course, the more environmentally friendly Proof of Stake model is taking over.

What is Ethereum Proof of Work ?

At its core, Proof-of-Work aims to curb and deter blockchain network abuse and attacks by requiring network actors to perform moderately hard (but realizable) calculations or computations which verify blockchain transactions and information – all for a reward. Proof-of-Work is the equivalent of a Rubik’s contest, where miners are pitted against each other in order to see who solves mathematical equations the fastest.

So, what type of “mathematical” equations and puzzles are miners solving? Quite a few.

For example, Proof-of-Work miners are using computational resources to typically solve hashes, verify the ultimate legitimacy of transactions (and prevent the infamous double-spending) and ensure a distributed trustless consensus – meaning the riddance of a middleman or trusted third-party to execute a function. Below are just some of the known Proof-of-Work functions executed by miners:

- Puzzles,

- Hash sequences,

- Merkle tree based,

- Integer factorization, and

- Hash function.

When a blockchain network is setting and facilitating transactions, it bundles them together in what is called a “block,” which is then mined (aka verified) by miners in order to ensure their legitimacy through solving a “mathematical puzzle.” Miners are then subsequently rewarded for broadcasting their successful completion and mining of a block in the form of a blockchain token (think ETH and BTC). Rinse and repeat.

And, as the network grows and garners more users and data, the mathematical equations become harder, ultimately needing more hashing power to solve them.

At present, the Ethereum network utilizes both the longstanding and established Proof-of-Work consensus mechanism alongside its new Proof-of-Stake counterpart via the Bitcoin Chain. Since this article is about mining let’s take a look at how exactly Ethereum mining occurs in the next section.

Unlike other Ethereum and cryptocurrency hardware wallets, which have a single point of failure, the CoolWallet S eliminates such vulnerability through its pairing with both iOS and Android smartphones – meaning hackers and other malicious actors must not only get ahold of your actual device but your phone as well.

Still confused about what Proof-of-Work is and how it functions in the facilitation and validation of transactions? Check out our ultimate guide to Bitcoin, where we break down Satoshi’s white paper and original idea behind PoW.

2. What is Ethereum Mining?

At its simplest, Ethereum’s GitHub explains the mining of Ether as:

“Mining Ether = Securing the network = verify computation.”

It’s first important to understand that Ethereum is an entirely different beast than Bitcoin (currently the largest cryptocurrency by market capitalization), and as such, has its own respective token known as Ether, or ETH), and a different hashing algorithm, known as Ethash.

Ethash, a modified version of Dagger-Hashimoto, necessitates the discovery and alteration of a once off or “nonce” input/value to the Proof-of-Work algorithm, which impacts the blockchain hash value for uniquely identifying data. Simply put, miners are using computational resources to essentially “guess” answers to a proffered puzzle until one gets it right and “wins.” On the Ethereum network, miners receive a directly proportional reward to their mining power, also known as hash rate.

When a miner identifies a hash which matches the intended goal, they will then be rewarded in ETH and subsequently broadcast the mined block across the Ethereum network for each node to validate and add to their respective ledger copies.

Enabling two-factor authentication is extremely important for securing your funds on cryptocurrency exchanges. Opt for using Google Authenticator over SMS, as there have been several high-profile security breaches where hackers have intercepted (and even swapped SIMs) of innocent investors and crypto HODLers. Google Authenticator generates time-sensitive codes, leaving hackers a finite window to access your account and funds.

So, how do miners execute such calculations and transactions?

Either on a CPU or “on the GPU through a combination of the Ethereum daemon and sgminer.” It’s extremely important to understand that mining Ether using a CPU is entirely not worthwhile and 100% not profitable, as even the most basic GPUs are nearly 200x quicker than CPUs for Ethereum and cryptocurrency mining.

Downloading an Ethereum Wallet

Just remember, after you mine your first bit of ETH (or your 2000th ETH), you’ll need somewhere for it to be sent. Cue an Ethereum wallet. However, proceed with caution, as some Ethereum wallets in the crypto-sphere warn against their users directing mining payouts to their wallet.

For example, the Jaxx Cryptocurrency Wallet webpage states:

“Jaxx is a lightweight wallet that is not ideal for receiving frequent tiny transactions that mining efforts in general produce. Receiving frequent mining rewards (or even faucet rewards) will create a lot of microtransactions that will need to be queried when you want to spend your balances.”

Furthermore, it reads, “We are recommending that you do not point your mining rewards to your Jaxx Wallet.”

Additionally, Coinbase, one of the largest online cryptocurrency exchange platforms states, “Please note that Coinbase cannot be used to receive ETH mining rewards.”

Should you send your mined Ether to your hardware wallet?

Finally, while it may seem like your best bet is to have your ETH mining rewards sent to your CoolWallet S or Ledger Nano S address, you should be looking at hardware wallets as more of a long-term savings option and not as your direct deposit address for frequent mining rewards.

At CoolWallet, we suggest users direct rewards to an online ETH wallet and later transfer it to a hardware wallet for long-term storage and protection.

Consolidation, consolidation, consolidation. Consolidate your ETH in your online wallet, and when there is a meaningful amount (and not dust), transfer it to your CoolWallet S or Ledger Nano S.

So, which Ethereum wallets should I download to send mining rewards to?

Best Ethereum Wallets for ETH Mining Rewards

Curious about the best Ethereum wallets to have your ETH mining rewards sent to? The Following 5 wallets are officially recommended by Ethereum.org.

- MetaMask browser extension for Chrome, Brave, Firefox and Opera

- Opera major browser with Ethereum integration

- MyCrypto web-based Ethereum wallet

- TrustWallet Ethereum compatible wallet for iOS and Android

- MyEtherWallet client-side Ethereum wallet

MyEtherWallet

With proven success in the security and Ethereum storage world, MyEtherWallet is a free, open-source interface to the Ethereum blockchain and network, allowing users to access and interact with the Ethereum blockchain through their node.

As MyEtherWallet is one of the most popular wallets for users looking to store their ETH and ETH mining rewards, beware of copycat and phishing websites and even fake phone support. Make sure to always double check the domain you are accessing and keep an eye out for the word “secure” and green “https” in the address bar. Bookmarking MyEtherWallet is an effective way to prevent accidentally accessing the wrong website or wallet. For an extra level of security, you can also access MyEtherWallet via the Cool Wallet S, which you can wirelessly connect to your computer via bluetooth. For a step-by-step guide in integrating your Cool Wallet S and MyEtherwallet, click here.

Furthermore, MyEtherWallet enables users to store all their ERC20 tokens, and is compatible with several hardware wallets, making it the preferred wallet for users seeking security and depth. And, MyEtherWallet is completely free (but for the transaction fees you’ll be charged when sending Ether).

MetaMask

Easily identifiable by its giant fox head logo, MetaMask is a browser plugin, bridge, and wallet, which allows users to run Ethereum DApps right in their browser without having to run the entire Ethereum node.

Creating a MetaMask wallet is incredibly fast and simple.It only requires users to copy down a 12-word seed to use in case of wallet loss and recovery.

As MetaMask is also one of the most popular wallets and extensions in the cryptosphere, make sure to bookmark the official MetaMask wallet link, and always verify a secure https connection.

Looking for a thorough explanatory video of MetaMask and how it’s connecting everyday web browsers to the Ethereum blockchain? Check out this video. And, for users looking to download MetaMask and start accessing Ethereum DApps and the blockchain, head on over to their easy-to-navigate website.

And, if you’re looking for a comprehensive guide on the best Ethereum wallets out there, look no further, we’ve got you covered in this all-encompassing blog post where we walk you through the difference between hot and cold wallets, the best Ethereum wallets available, paper and steel wallets, and more!

Now that we’ve taken you through the basics of Ethereum mining, let’s get started on how to actually mine Ethereum.

When accessing a cryptocurrency exchange website or online (hot) wallet, always double check the URL. Make sure the green colored “secure” and padlock shows up in the address bar. A good percentage of crypto phishing attacks occur due to users failing to verify and correctly identify the website they are accessing, later inputting highly sensitive information. The CoolWallet S was the first hardware wallet to partner with MetaCert Protocol – a decentralized reputation and trust protocol – to guard against malicious phishing attacks, allowing users to rest assured that they are accessing the correct website address.

Trust Wallet

Trust Wallet, officially supported by Binance, is a new mobile Ethereum wallet which works with any ERC20 and ERC721 token, and is compatible with all the main forks in the Ethereum ecosystem blockchains – Ethereum, Ethereum Classic and Callisto. Learn more here.

3. How to Mine Ethereum: Ethereum Mining Rig & Software

Ethereum’s block difficulty has significantly increased in just the past year, translating to less ETH received per mining rig and an overall more competitive mining ecosystem. ETH mining difficulty did in fact continually increase in 2020 especially in the last quarter.

How Will Ethereum 2.0 Affect ETH Mining?

When accessing Ethereum’s GitHub page, users and potential ETH miners will be greeted with the message:

“Becoming an Ethereum miner is not recommended. Ethereum is going to transition to Proof-of-Stake, making Ethereum mining obsolescent. Becoming a miner would involve investing in a mining rig (several GPUs), plus maybe other hardware if needed, like a compatible computer), which is probably unlikely to get a return on investment by the time that PoS is implemented.”

Block difficulty on the network may have been drastically increasing over the last year, but so are the mining rewards, meaning ETH mining might still have a couple of years before it goes away. Furthermore, the price of ETH has dramatically risen recently. With that being said, profits are still not guaranteed in 2021.

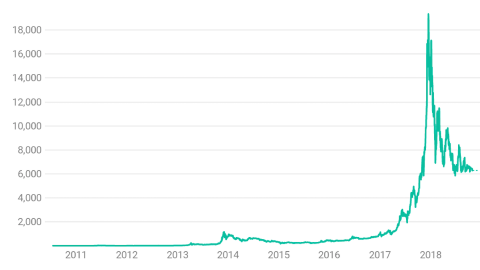

Historical Mining Reward (Source: etherchain)

Ethereum’s transition to hybrid PoW/PoS (as expanded upon in Section 5) is set to drastically reduce ETH block rewards, with a subsequent and inevitable complete transition to PoS which will do away with mining altogether. But looking at the official ETH 2.0 roadmap, it appears that the current PoW blockchain will remain operational until near the end of Phase 2.

As of February 2021, we are still at Phase 0, which means that we probably have around 2-3 years left to mine Ethereum, but don’t count on it. If you wanna be smart, it would be best to assume that you have a shorter window to mine Eth1 as the rewards are expected to decrease over time. As the roadmap says:

“In Phase 0, 1, and 2 the main PoW chain (Eth1) will remain live while testing and transitioning is happening on the Eth2 chain. This means that rewards will be paid to both Ethereum 2.0 validators as well as the normal PoW block rewards. Therefore, the combined inflation of the two chains may spike initially but then start to trend towards the 0-1% range as the PoW chain is gradually de-emphasized.”

Pay attention to that last part. But then again, ETH is at a new all-time high this year, having breached the $1,800 barrier. We don’t know how long this will last and how high it can go in 2021. If it can maintain above $1,000 levels or go higher, then mining ETH will definitely be profitable for a while.

Ethereum Mining Profitability Calculator in 2021

Before you purchase (or build) your own Ethereum mining rig, we strongly suggest you head over to one of the various Ethereum mining profitability calculators to input your rig’s hash rate, power consumption, and cost per kWh. Doing so will give you a fair representation of what you can expect to make (or lose) in a day, month, or year when mining Ethereum.

For example, if your Ethereum mining rig and GPU mines roughly 168 MH/s, then at an ETH price of say $1,654, you are looking at earning roughly USD $16.18 per day or $5,905 per year. That’s accounting for your annual power cost of nearly USD $150. Keep in mind that this is with only one GPU Ethereum miner and is likely a grossly underestimated number. Not bad right?

Head on over to https://www.cryptocompare.com/mining/calculator/eth to play around with various numbers (hashing power, power consumption, cost per kWh, and pool fee) in order to get a better understanding of the actual costs and profits associated with mining Ethereum.

If you are living in the United States, you’ll likely be paying at least USD .10 per 1000 watts per hour, which could mean upwards of $2.50 per day in power costs. While the following link and map outline the cheapest and most expensive countries to mine Bitcoin, it still may give you a more complete picture of which countries will give you the best chance at setting up and running a successful Ethereum mining operation. You can check out the cheapest and most expensive countries to mine Bitcoin here – with the cheapest being Venezuela, and most expensive being South Korea.

Furthermore, it’s important to identify a mining pool (as addressed in section 6) with low fees, as some are known to take up to 10%.

Also, it’s important to understand that mining rigs are depreciating assets, so not only could you be losing money by mining Ethereum, you potentially might not be able to sell your rig after you’re done with it – leaving you even deeper in the hole. To gauge just how much your Ethereum mining rig may depreciate, head on over to Amazon.com to peruse the various mining rigs for sale and their respective costs.

We strongly suggest anyone considering mining Ethereum to develop a well-thought-out mining and profitability outline and game plan, otherwise, you may be surprised come ETH payout and utility bill time. This is not something you just jump right into.

Finally, just remember to factor in Ethereum’s transition to a hybrid PoW/PoS consensus mechanism, with the overall intention of ultimately doing away with PoW together in the next few years, so ask yourself: “Will I be able to turn enough of a profit to make mining ETH worth it over the next 1-2 years?” Luckily, if ETH manages to maintain its current prices then the answer would be yes.

If you’ve run the numbers and have decided it is worth the risk, then this guide is for you!

And remember, this post is not to deter Ethereum miners but to present the facts of the current Ethereum mining climate and profitability. Mining Ethereum or any cryptocurrency does carry risk, and there is a very real chance that you may never see profits from mining ETH, BTC, or altcoins. Make sure to never put more money into a mining rig or cryptocurrency investment than you are prepared to lose, and everything else will be gravy.

Looking to read up on the history of Ethereum, the infamous DAO attack, what ERC20 tokens are, Ethereum’s respective advantages and disadvantages, and how to purchase ETH? Check out our comprehensive guide to everything Ethereum. Furthermore, if you’re looking to read up on Bitcoin and other major cryptocurrencies taking the blockchain ecosystem by storm, check out our cryptocurrency guide corner here.

Etherscan, an Ethereum blockchain and analytics tool is also another popular calculator for determining Ethereum mining profitability, along with Whattomine.com, which allows you to compare altcoin profitability to both Ethereum and Bitcoin.

Now that you’ve determined you’d like to start mining ETH and have established a formidable attack plan, it’s time to decide which hardware and software you’ll use. Should you build your own? Purchase online? Or pool your resources with a few friends to set up a communal rig?

Ethereum Mining Hardware & Software

The most common route Ethereum miners take is the purchasing of an already assembled Ethereum rig. However, it’s not unheard of to make your own, and in today’s competitive cryptosphere, where mining rigs are selling in the tens of thousands (if not more), it could be a good way to save some money – if you know what you’re doing.

Take this section as an introductory guide to just some of the materials and components you’ll need when assembling your ETH mining rig, and not as creed or doctrine.

Building Your Own Ethereum Mining Rig

Should you decide to build your own, below are just some of the components you’ll need to purchase and assemble before commencing with the mining process. In order to build a comprehensive and high functioning Ethereum mining rig, you’re likely going to spend anywhere from USD $1500 to $4000.

- Frame: You’ll need a mining frame to stack and separate the various (or single) GPU you’ll be using to mine Ether.

- Motherboard: You can easily find a motherboard at your local computer store or by ordering one on eBay or Amazon. Refrain from purchasing a used one if you can.

- Hard Drive: Look for a hard drive with high operating speeds and faster boot times, this is one part of the rig you really shouldn’t sacrifice quality for!

- CPU: As it isn’t the biggest concern for Ethereum mining, you can choose a cheap processor. But, make sure to choose one that has a fan!

- Power supply units (PSUs):

- RAM: A single 4GB RAM-card is likely enough when first getting started.

For a comparison table of the most efficient and best GPUs on the market in 2018, check out this CoinTelegraph article.

And, if you’re really serious about building your own Ethereum mining rig, this article which explains how to build a universal mining rig for the Ethash algorithm coins, is a great place to start.

The Most Profitable Ethereum Miner

The best Ethereum miner in the market is currently the Linzhi Phoenix, which was rolled out 3 weeks after the launch of Ethereum 2.0, an indication that Ethereum mining is still very much alive.

It boasts a hashrate of 2600 Mh/s, which is over 5x more powerful than the next best Ethereum miner, the Innosilicon A10 Pro, which has a hashrate of 500 MH/s. Clocking in at 3,500 watts per hour, the Phoenix Miner is also more energy-efficient.

You can also check out a demo of the new Linzhi machine by F2Pool on Youtube.

Purchasing an Ethereum Mining Rig

Purchasing an already-assembled and functioning Ethereum mining rig is the most common of options for getting started, as not everyone has a handy background in assembling computers.

Check out cryptocompare.com if you’re curious about what an Ethereum mining rig costs, along with the “payback period” for you to break even. For example, this 170MH/s Ethereum mining rig is going for a cool US $1,521, and boasts a nearly 131-day payback period, meaning users who purchase such rigs will break even in 131 days or roughly over four months. In addition, they will be earning roughly $491 per month or $5,977 per year in ETH.

Note that while mining rigs with a high hash rate may solve mathematical equations and calculations faster than lower hash-rate rigs, they typically come at a pretty penny and generally use more electricity, ultimately decreasing your bottom line and profits.

Ethereum Mining Software

Once you’ve selected your requisite Ethereum mining hardware, you’re going to need to install software.

For starters, Ethereum miners will need to install a client in order to connect to the Ethereum network. Using the directions for your appropriate OS, you can download Geth here. Post-download, your own personal node will be able to interact with other nodes on the Ethereum network and will act as the interface for your personal deployment of smart contracts. Just know that the entire Ethereum blockchain size has exceeded 1TB.

But wait, that’s not all. If you’re looking to do more than just interact with nodes on the Ethereum network and actually want to mine “cold, hard, ETH,” we recommend downloading Ethminer. Ethminer will effectively authorize your GPU to run the hashing algorithm which is integral for securing the ETH network through PoW. And, for users with more than one ETH mining rig, you can install Awesomeminer.

Finally, don’t forget to test your connection, by establishing a private test network. Doing so is an extremely helpful tool for testing public contracts and testing your overall mining capacity. In an individual private test network, there are no other users, so your GPU is solely responsible for locating and validating blocks.

How Do I Sell My Ethereum For Fiat?

After you’ve accumulated a healthy stack of ETH, you’ll either want to HODL it, trade it, or convert it into fiat (USD, GBP, SGD). Should you decide to sell your ETH for fiat, it can sometimes be difficult to locate a proper medium and exchange to sell it on. After all, mining ETH could be your job and you might be reliant on the mining payouts for your rent or groceries.

Let’s take a look at three of the best places to sell your ETH for fiat.

Coinbase

Offering fiat currencies in over 32 countries and cryptocurrency storage in nearly 190 countries worldwide, Coinbase is a go-to online exchange and platform for converting your Ethereum into fiat.

Founded in 2012, Coinbase grew to over one million users by 2014, making it one of the largest and frequented online exchanges and purchasing platforms. At present, they boast over 13 million users and revenue in excess of US $1 billion, so there’s no need to worry about having an order filled.

Coinbase is one of the simplest exchanges and platforms to sell your Ethereum, as they support both mobile and web interfaces for doing so, and a straightforward withdrawal option, where you only need to enter your bank account information. Note that when selling your ETH on Coinbase to a U.S. bank account or the USD Coinbase wallet, you’ll be looking at fees right around 1.5% or nearly 4% in PayPal withdrawals.

Kraken

If you’re looking to sell your ETH on a reputable exchange, look no further than the Kraken exchange. Known for being the world’s largest Bitcoin exchange in terms of Euro liquidity and volume, Kraken has been highly regarded in the cryptocurrency exchange space due to its transparent team and numerous fiat pairs.

Signing up for Kraken is quick and easy, however in order to deposit and trade between currencies you’ll need at least Tier 1 verification, which will require your name, DOB, residence, and telephone number. Once set up with Kraken, selling your ETH is as simple as looking for the “Funding” tab, where you can choose ETH (Ether) to generate an address and send your mined Ether, followed by converting it to either USD, CAD, GBP, JPY, or EUR.

Note that for domestic US withdrawals, Kraken requires users to pass Tier 3 verification, which requires proof via a government-issued ID, utility bill, social security number (for US users only), and an ID confirmation photo. Finally, Kraken calculates a user’s withdrawal fees based on their maker/taker status and thirty-day trading volume, resulting in fees ranging anywhere from 0% to just over .25%.

CEX.io

Besides authorizing users and investors to purchase ETH and BTC with their debit and credit card, CEX.io also allows users to withdraw their ETH in fiat. Unlike Coinbase, which does restrict a handful of countries from accessing and using it, CEX.io is available in 99% of all countries worldwide and nearly 24 U.S. states, meaning, there’s a good chance your location and country is covered.

Depending on your account type and location, users can withdraw their fiat by:

- Direct withdrawal to Mastercard/Visa (yes, you’re debit card),

- Swift bank transfer (EUR),

- SEPA transfer (EUR), or

- Crypto capital transfer (USD/EUR).

What’s absolute “killer” (CEX.io’s words) is their launch of instant withdrawals to payment cards in fiat, ultimately easing mass adoption and purchasing power. In most instances, fiat withdrawals are processed instantaneously, with fees ranging anywhere from 1% (crypto capital) up to 2% or EUR $3.80 cap for Visa.

Above are three of the easiest and most convenient options for ETH miners looking to unload and sell their ETH for fiat. Furthermore, all three are viable platforms for converting one’s ETH into other cryptocurrencies, such as BTC or BCH. Just make sure you’ve enabled two-factor authentication for logging onto both platforms, as centralized exchange and platform hacks can happen at the drop of the dime, so it’s essential you add a secondary security layer.

4. Ethereum Mining And the Transition to Proof-of-Stake

Ethereum’s Ethereum 2.0, AKA Serenity, is a protocol overhaul, set to transform Ethereum from PoW to PoS completely to make the network faster, cheaper and more environmentally friendly.

As mentioned throughout this post, Proof-of-Work (PoW) exhausts large amounts of energy and resources, ultimately forcing miners to square off against one another. After all, as PoW is a consensus mechanism – with the goal of verifying and ensuring valid information to the blockchain ledger – it requires service requesters in order to perform and run smoothly. Specifically, the most common issues and downfalls of PoW include:

- Inefficient power and energy consumption,

- Potentially predatory ecosystem (where those with funds to purchase more powerful mining rigs are the ones to prosper), and

- Some degree of centralization, where large mining pools can “team up” to occupy 51% of the network.

Such extreme exhaustion of resources and energy ultimately leads to exorbitant and wasteful energy costs, something Ethereum founder Vitalik Buterin and the ETH community are looking to curb. The Eth 2.0 implementation guide and specs were first released on the Ethereum Github page, and the Beacon Chain, Ethereum’s proof-of-stake blockchain, was been deployed last December 1, 2020.

We are currently at Phase 0, which means the PoW and PoS are working alongside each other, and we may have two or more years of mining before it is rendered obsolete in the network.

What is Proof-of-Stake?

For those unsure of what Proof-of-Stake is, it simply refers to a consensus algorithm that depends on a validator’s economic stake in the network.

While Bitcoin rewards users and participants for solving “cryptographic puzzles” for transaction validation and verification, PoS rewards users who “propose” and vote on future blocks by “staking” their base currency (in Ethereum’s case, this would be ETH).

For an excellent example of Proof-of-Stake and how it differs from Proof-of-Work, check out this educational video by YouTube channel “Blockgeeks.”

In the next section, we will explore Ethereum 2.0, as well as its specifications and purpose.

What is Ethereum 2.0?

Ethereum 2.0 is the recently-launched upgrade of the Ethereum network, which is aimed to increase its speed, efficiency and scalability. Ethereum 2.0 will solve network congestion by providing a dramatically higher transaction capacity.

The Serenity upgrade will slowly implement multi-phase changes in its system architecture and design. We are currently at Phase 0, which saw the rollout of the Beacon Chain. In later Phases, other major upgrades such as sharding will be introduced.

What is Ethereum’s Beacon Chain?

The highly anticipated Beacon Chain proof-of-stake update, which was implemented in Ethereum in December 2021 after many delays, enables users to validate the network through staking, which runs alongside the mining operations conducted on Eth1, the original proof-of-stake blockchain.

How to stake Ethereum in 2021

In order to participate in the staking process, you need to deposit 32 ETH in a smart contract, which will be locked for a certain period of time. This will serve as an insurance for your good behavior, as your funds could be forfeited either fully or partially if you conduct any form of malpractice. As a validator, be sure to avoid doing monkey business and you will be rewarded with full payouts in ETH periodically.

What is Sharding?

Sharding, simply put, is an implementation that enables the splitting of a blockchain into several smaller partitions, collectively known as shard chains. Sharding is the long-awaited scalability solution of Ethereum, which would allow the network to reach transaction speeds of 100,000 tps.

How Does Ethereum 2.0 Work?

As a proof-of-stake chain, validators are essential to the network since its infrastructure and maintenance rest on them. Here are the three main jobs of a validator:

- Validate transactions conducted on the Beacon and Shard Chains.

- Propose and add blocks to the Beacon or Shard Chains.

- Report any form of malpractice done by other validators.

And with these three functions, the Beacon and Shard Chains can maintain normal operations. But why are all these complex upgrades necessary? Why not keep the Ethereum chain as is?

Core Reasons for Ethereum 2.0

- Scalability – PoS is set to overhaul Ethereum’s scalability issues (look no further than the troubles associated with the DeFi craze recently) through sharding.

- User Experience (cost and speed) – What do users value most in payment systems? The answer is definitely both speed and low costs. We want to send payments as fast and cheaply as possible without, of course, compromising security and decentralization, like other blockchains do.

- A shift towards a truer, decentralized blockchain – Unfortunately, the majority of hash rates on the blockchain are concentrated within core mining pools, creating an unfair and uncompetitive mining environment. PoS provides a fair shot to anyone seeking to stake their tokens in order to validate.

- Energy efficiency – With Bitcoin and Ethereum mining costs alone in the billions, PoS is set to tame this power eating consensus mechanism, which will subsequently have a direct impact on our very own environment.

- Deterrents to malicious attacks and 51% attacks – As users and validators are investing a stake (ETH), they can’t pool together such stakes to make it more valuable, deterring large-scale attacks and protecting the network from a 51% attack.

As of writing, Ethereum boasts a $204.5 billion market cap in February 2021 (according to CoinMarketCap).

5. How to Join an Ethereum Mining Pool in 2021

Considering joining an Ethereum mining pool? Look no further, we’re taking you through what mining pools are, the different reward schemes offered, and how to mine both Ethereum and altcoins.

In the Wild Wild West arena of cryptocurrency mining, mining pools are simply the “pooling” of mining resources by miners, who distribute and share processing and computational power of the network, ultimately splitting any rewards in a proportional manner.

Mining pools require all miners to perform PoW and arose out of the difficulties associated with ineffective and slow block generation and mining times. So, miners decided to begin pooling their computational resources to generate blocks more swiftly, ensuring a consistent and steady reward stream, rather than a sporadic and one-off reward.

Several reward schemes and approaches associated with mining pools include:

- Pay-per-Share: PPS offers miners instantaneous and guaranteed payouts according to one’s contribution to the percentage or probability the mining pool identifies and mines a block. Under pay-per-share, miners receive rewards from the mining pool’s existing balance, meaning they can withdraw it immediately, ultimately cutting down on potential payment variance (as risk if shifted to the mining pool’s operator).

- Proportional: As its name implies, proportional payouts and rewards and distributed according to the amount of one’s own shares. However, unlike PPS, proportional payouts are only calculated at the end of a round.

- Pay-per-last-N-shares (PPLNS): Similar to ‘Proportional’ rewards, pay-per-last-n-shares is calculated based on the number of last shares (instead of total shares of the last round), meaning it typically favors loyal mining pool members.

- Geometric & Double Geometric: The Geometric Method grants miners the same reward no matter what, ultimately guarding against miners who participate at the beginning of a mining round (where reward expectations are high compared to efforts and pool contributions). Combining both the ‘Geometric Method’ and PPLNS, the Double Geometric Method is entirely score based, meaning that miners will receive rewards based on a given score which grows exponentially.

Now that we’ve gone through what a mining pool is and several reward mechanisms associated with mining pools, let’s turn to what Ethereum mining pools are and a list of some of the most popular.

What are Ethereum Mining Pools?

Ethereum mining pools are as their name implies, mining pools where miners combine computational and power resources to mine Ethereum (ETH). Joining an Ethereum mining pool is a great way to ensure quicker and more consistent payouts for solving an Ether block while cutting down on the overall volatility of the mining process.

Additionally, some of the less glamorous costs associated with mining alone include:

- High electricity costs,

- Lack of space,

- Lack of ventilation,

- Loud noise, and

- Heating issues.

When selecting an Ethereum mining pool, it’s important to weigh several factors before choosing one, such as whether it’s fees are offset enough through returns, such fees are not exorbitant or too high, and the server location (after all, the closer your Ethereum mining rig to the server, the more efficient your mining).

In this Vice article, the author (and Ethereum enthusiast) undertakes to build his own Ethereum rig and later joins a mining pool. He notes, “Although I am only contributing 120 MH/s to the pool I joined, this will result in about 25 Ether per year for my rig. Based on the mining difficulty and price of Ether at the time of writing, this should be nearly $45,000 per year after electricity costs.”

Let’s take a look at three of the best Ethereum mining pools in the blockchain space today.

Best Ethereum Mining Pools

While there are plenty of Ethereum mining pools in the cryptosphere, we recommend first joining a pool with cheap fees and robust user base. When choosing an Ethereum mining pool to join, keep three core things in mind; the pool’s functionality, size, and trustworthiness.

Choosing a pool that boasts all three will save your headache and hassle in the future, and enable you to better identify payout time and load.

Sparkpool

With a whopping 88.7 TH/s, Sparkpool is currently the world’s biggest Ethereum mining pool. Using the PPLNS reward scheme, Sparkpool boasts over 221,300 miners and 450,200 workers. The pool was born out of a Chinese Ethereum community called Ethfans, and has grown to become a global pool, with servers in USA, Europe, Taiwan, Southeast Asia, etc.

Besides ETH, Sparkpool also has mining pools for CKB and BEAM. Furthermore, it also offers staking services for ETH 2.0, as well as Cosmos, Solana, and other PoS networks.

One perk of using Sparkpool is that it doesn’t have stringent requirements. It also charges a rather low pool fee of 1%. However, be sure to do your due diligence in calculating profits, otherwise you might end up with losses.

Ethermine

When it comes to the people’s choice for Ethereum mining pools, Ethermine is at the top of the list, and possesses a hash rate of 20.8%, making it the second-largest Ether mining pool out there. Not to mention it is being used by over 128,306 miners.

Like Sparkpool, Ethermine is known for charging a small fee of 1% for all received ETH rewards. It is also supported on both mobile and desktop versions, making it one of the most convenient pools in the space.

Several distinctive features of Ethermine include:

- Anonymous ETH mining,

- Different servers across various continents,

- Extremely accurate calculation of hashrate,

- Payment for all found blocks,

- Customizable payment threshold, and (as mentioned above)

- Access by third-party applications such as iOS and Android.

At the moment, Ethermine only supports Ethereum (ETH), Ethereum Classic (ETC), and Zcash (ZEC).

Nanopool

Noted for being the fifthlargest Ethereum mining pool in the space, Nanopool supports a community of over 37,000 Ethereum miners and offers participants the same low fee of just 1%. What Nanopool lacks in size it makes up in user-friendliness and decentralization (has widely distributed servers).

Nanopool’s UI is simple and easy to use, and supports 7 cryptocurrencies, namely:

- Ethereum,

- Ethereum Classic,

- Conflux,

- Zcash,

- Monero,

- and

- Ergo.

Nanopool does not concentrate on ETH miners from just one part of the world, and miners are distributed around all corners of the globe, as servers are provided in Europe, Asia, Eastern and Western United States, Japan, and Australia.

If you’re looking to join Nanopool, just make sure your rig meets the strict requirements set forth by the pool, as it requires:

- GPU

- Stable internet

- 4+GB RAM,

- Ethereum account, and

- GPU miner with at least 4GB (with the recommended being the latest AMD and Nvidia GPU drivers).

2Miners

2Miners is the youngest pool in the list but probably the most ambitious, having the most number of supported coins. This anonymous mining pool was established at the end of 2017. 2Miners provides unique design and it is as user-friendly as any mining pool could be:

- Quick start option with ready-to-go mining software

- Telegram monitoring bot

- Telegram new block notification bot

- Email monitoring service

- Detailed statistics

- 24/7 support

2Miners has got both PPLNS and SOLO pools. PPLNS fee is 1% and SOLO fee is 1.5%. Being the multicoin pool 2Miners supports more than 20 coins including such popular cryptocurrencies as Ethereum Classic, ZCash, Bitcoin Gold and others.

Maybe you’re interested in mining altcoins instead of one of the major cryptocurrencies dominating CoinMarketCap and the cryptosphere, let’s take a look at how to mine altcoins below.

What is Multipool Mining?

For the ambitious renegades of today’s blockchain ecosystem looking to mine altcoins, you’re in luck. Multipools are mining pools which alternate between the mining of various altcoins, depending on the profitability of the coin.

For example, should a multipool’s algorithm determine X altcoin to be the most profitable in the current market (via block time and exchange price), then the pool will switch over from Z coin and start mining X.

But, does this mean I will have to download or acquire numerous altcoin and cryptocurrency wallets?

Not exactly. As multipool mining could theoretically be switching between altcoins quite frequently, a good portion of multipools will automatically convert and exchange whichever altcoin is mined at the time into a more mainstream and widely accepted coin (such as Bitcoin or Ethereum).

Such a method stands to enable participants to receive more coins in a mainstream currency than they would receive from simply mining that currency by itself. Additionally, the multipool automatic conversion may drive demand for the mainstream coin, which may have a stabilizing effect on the market.

Curious about some of the coins multipool offers? Check out one of the most popular merged mining pools at https://www.multipool.us/.

With Ethereum’s transition to a hybrid PoW/PoS consensus mechanism, the question of whether PoS will pose a similar centralization risk to mining pools as that of PoW has been thrown around.

Proof-of-Stake as a Centralization Deterrent

Theoretically, proof-of-stake may be more decentralized than proof-of-work. However, Ethereum 2.0’s first phase had only launched less than 3 months ago, and the proof-of-work chain is still ongoing, so we don’t know for sure yet.

While it’s generally accepted that both Ethereum and Bitcoin require only (roughly) three mining pools to execute a 51% attack on the network, PoS accounts for such “pooling” of resources and energy through a much stricter and higher trust requirement and can ultimately destroy a participant’s stake or deposits if need be. Simply put, the “slashing” or destruction of a participant’s stake or deposits incentivizes validators to refrain from conspiring and correlating large-scale attacks.

Finally, PoS offers a less harmful recovery option for networks plagued by a 51% attack, as the network does not need to change to a new and different mining algorithm.

When purchasing Ethereum from a cryptocurrency exchange, we strongly recommend doing some due diligence on the exchange’s history. Have there been any large-scale breaches or hacks? Are orders able to be filled in a timely manner? What trading pairs does it offer? Are you able to withdraw your funds within a reasonable time? These are just a few of the questions you should be asking.

Also, while it may seem like common sense, you may not join a Bitcoin mining pool to receive payouts in Ether, as they are completely different.

6. How to Store Your Ethereum Offline

Enabling users to keep cold storage at their fingertips, the CoolWallet S is the ultimate hardware wallet for securing your Ethereum, ERC20 tokens, Bitcoin, and other cryptocurrencies.

Now that you’ve successfully mined your first bit of Ethereum, or other cryptocurrencies such as Bitcoin, it’s time to figure out how to best store and protect it. Or, maybe you’ve been investing in Ethereum for quite some time now and have accumulated a healthy stack of ETH that needs safeguarding.

Either way, let’s take a look at how to store your Ethereum offline.

The first rule of storing ETH and other cryptocurrencies is that once you’ve accumulated more than one month’s salary in crypto, it’s time to start considering moving it offline to a hardware wallet. Or, if you’ve collected an amount that you aren’t alright losing, then it’s time to pick up your first Ethereum wallet.

Think of Ethereum and cryptocurrency hardware wallets as your own personal safe (or underground bunker), where your private keys are stored offline and out of the control of a centralized entity – one that’s highly prone to malicious hacks and other online attacks.

Just as you wouldn’t keep thousands of dollars of fiat (USD, SGD, GBP) in your wallet and openly flaunt it, you shouldn’t be keeping large sums of crypto online and at the hands of a centralized entity. It’s time to turn to blockchain and cold storage.

A small investment in security now could pay dividends by protecting your funds against malicious hacks and theft in the future.

The CoolWallet S: Crypto at Your Fingertips

For users and investors looking to “hold their ETH” and other cryptocurrencies at the tips of their fingers, the CoolWallet S is your ultimate hardware wallet for cold storage and security. The CoolWallet S pairs with both your Android and iPhone, supporting a seamless and quick setup, minus all the clunky USB cables and hassles associated with other cryptocurrency hardware wallets.

The CoolWallet S not only emphasizes security but anonymity too, enabling users to anonymously set up and secure their investment in mere minutes. Furthermore, it’s the first Ethereum and cryptocurrency hardware wallet to partner with decentralized reputation and trust protocol, MetaCert Protocol, ensuring users don’t fall prey to malicious phishing scams. And, for users worried about its durability and ability to weather the elements, take solace in knowing that your wallet is:

- Heat and cold resistant,

- Impact resistant,

- Waterproof, and

- Tamperproof.

Rain, sleet, or malicious hack, the CoolWallet S is your ultimate wallet for end-to-end Ethereum and cryptocurrency storage and security.

If you’d like to read up further on how the CoolWallet S is changing the cryptocurrency cold storage game and bringing value to an otherwise attack-prone industry, head on over to our FAQ or check out our comprehensive blog.

When mining Ethereum for extended periods of time, check your computer power settings. For example, by default, most computers will “go to sleep” at some point and ultimately stop mining, so make sure you change your power settings to never sleep. Doing so will ensure your computer remains active and continues mining Ether (even while you’re sleeping.

7. Additional Ethereum Mining Resources

While the Ethereum GitHub warns future ETH miners that getting started mining ETH is not recommended, it still can be a viable way to increase your Ethereum and cryptocurrency portfolio, all while contributing to the blockchain ecosystem.

Ethereum and cryptocurrency mining is the epitome of the blockchain, as it gives power to the very people who make up its core and ensure they have a direct hand in validating and verifying potentially world-changing information.

The blockchain is in the midst of overhauling and disrupting our traditional institutions and mechanisms which have failed to modernize appropriately, so it’s incredibly important there is support from all fronts – from advisor roles to functioning and transparent exchange, all the way to honest and motivated miners.

To help assist in your overhaul of today’s ineffective and outdated institutions, below are several more resources which further enrich your Ethereum and cryptocurrency mining experience.

- The CoolWallet Guide to Ethereum: If you’re looking for a comprehensive breakdown of Ethereum, it’s history, core values, and how it’s shaping our present day blockchain ecosystem, look no further. We have you covered.

- Ethereum White Paper: At the heart of Ethereum is its white paper, establishing a formal outline and definition of the Ethereum protocol and network (as penned by Ethereum founder Vitalik Buterin).

- Ethereum Yellow Paper: Supporting Ethereum’s white paper is the yellow paper by co-founder Gavin Wood. Wood’s yellow paper breaks down the Ethereum protocol in a more technical manner.

- Official Ethereum Website: For everything Ethereum, including the original and primary Ethereum wallet to have your ETH mining rewards sent to.

- EtherMining Reddit: Got any questions about mining Ethereum? Reach out to the Reddit community for feedback, tips, and mining tricks.

- Ethereum Reddit: For those looking for broader and more general information about the Ethereum protocol, head on over to their subreddit.

- GitHub: Providing all technical documentation and guides for Ethereum and the future of Casper, check out Ethereum’s GitHub to discover what Ethereum developers have been working on.

- Etherscan: Looking to check to see if your ETH mining rewards were actually sent to your wallet address? Etherescan is an Ethereum blockchain explorer and analytics tool enabling users to search for Ethereum addresses, transactions, tokens, and prices.

- CoinMarketCap: The popular tracking website and tool for users looking to check Ethereum and other cryptocurrency prices.

- Ethereum Twitter: Want to keep up with all the latest Ethereum updates? Ethereum’s official Twitter posts on social gatherings, recent commits, and other important milestones in the Ethereum protocol’s development.

Although Ethereum is already running a hybrid PoW/PoS consensus mechanism, mining Ethereum can still be a viable source for building your crypto portfolio and it may be a slow transition towards a purer PoS.

According to ConsenSys Head of R&D Robert Drost:

“New investment decisions to build out more mining hash power for Ethereum do now have an additional time-risk factor as the reward stream now appears finite. On the other hand, Eth has been trending upwards nicely, so as you say there can be money to make in battling for as many coins as possible beforehand!”

Happy HODL’ing, and remember, once you’ve accumulated more than one month’s salary in Ethereum (or any other cryptocurrency) and aren’t alright with losing it or having it hacked, consider purchasing a hardware wallet to ensure your ETH and future investments are protected and secure.

Written by Werner Vermaak

About CoolWallet

CoolWallet S is the most secure crypto hardware wallet for Bitcoin, Ethereum, Litecoin, Bitcoin Cash, ERC20 Tokens, and other quality crypto assets.

If you’re looking to have full control over your Bitcoin ownership, the best cold (offline) storage, while retaining complete access to buying, selling and trading features on platforms such as ChangeHero, Changelly, BitPay, Binance DEX, UniSwap (and other WalletConnect decentralized exchanges), then your choice is easy.

The CoolWallet S is a revolutionary hardware wallet first released in 2016. Its first-gen predecessor was the world’s first Bluetooth mobile hardware wallet. The CoolWallet S allows you to keep your crypto in cold storage, completely offline, in full control, and in your real-world wallet.

The CoolWallet’s EAL5+ secure element, encrypted military-grade Bluetooth protocol, and several biometric security checks ensure that you can take it with you everywhere you go, without the need to use custodial solutions like centralized exchanges.

Learn more: Here are 10 reasons why you should get a CoolWallet in 2021!

Disclaimer: CoolBitX provides these blog posts for general educational purposes only. Information on this blog expresses the opinion of the author only. It does not constitute professional legal or financial advice and should not be considered as such.

The author or company may update the information on this article at any time without prior notice and do not guarantee the work to be up to date and accurate. To the best of our knowledge, the information provided here is factual at the time of writing.